Notably for a piece of analysis attempting to explain Amazon’s business practices, the text of Khan’s 93-page law review article does not include the word “cash” even once.

The problem with this argument should be immediately apparent. For the moment, let’s ignore the classic recoupment problem where new entrants will be drawn into the market to win some of those monopoly prices based on the new AVC that is possible. The real problem with his logic is that Sussman basically suggests that if Amazon sharply lowers AVC — that is it makes production massively more efficient — and then does not drop prices, they are a “predator”. But by pricing below its AVC in the first place, consumers in essence were given a loan by Amazon — they were able to enjoy what Sussman believes are radically low prices while Amazon works to actually make those prices possible through creating production efficiencies. It seems rather strange to punish a firm for loaning consumers a large measure of wealth. Its doubly odd when you then re-factor the recoupment problem back in: as soon as other firms figure out that a lower AVC is possible, they will enter the market and bid away any monopoly profits from Amazon.

Kristian Stout & Alec Stapp

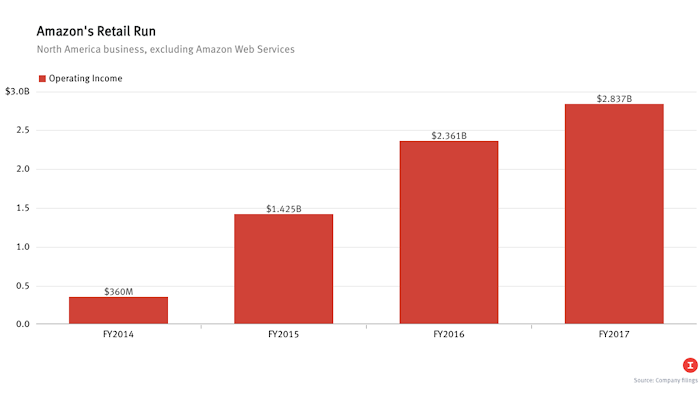

Interesting counterargument in the antitrust discussion around Amazon. It basically states that Amazon has lower prices because it plans to be more efficient than the competition – and always investing into becoming more efficient, just as any model capitalist company should. They are cash-flow positive and the retail business in the US is overall profitable, so there are few arguments to sustain a case for predatory pricing. Of course, that does not mean Amazon is not engaging in other anticompetitive practices, such as discriminating against third-party sellers on its online store, and vertical integration.

The idea of basing a company on future increased efficiency lies at the center of Uber’s value proposition as well – except in Uber’s case the ultimate efficiency was replacing human drivers with self-driving cars. As achieving this particular technological advancement seems to recede further into the future, so do the chances of Uber turning profitable.

As a side-note, I have been meaning to read Lina Khan’s journal article about Amazon, but I didn’t feel like working my way through almost 100 pages to get to the point – and I’m even less likely to do so now, since the article above does a good job dismantling her arguments in a couple of paragraphs. I also found it suspicious how John Gruber linked to her article and praised her conclusion – that guy will believe anything that makes Apple’s competitors look bad. She even acknowledges in the text that, in the suit against Apple and book publishers for price fixing, the DOJ found “persuasive evidence lacking” to show that the company had engaged in predatory practices

.

Post a Comment