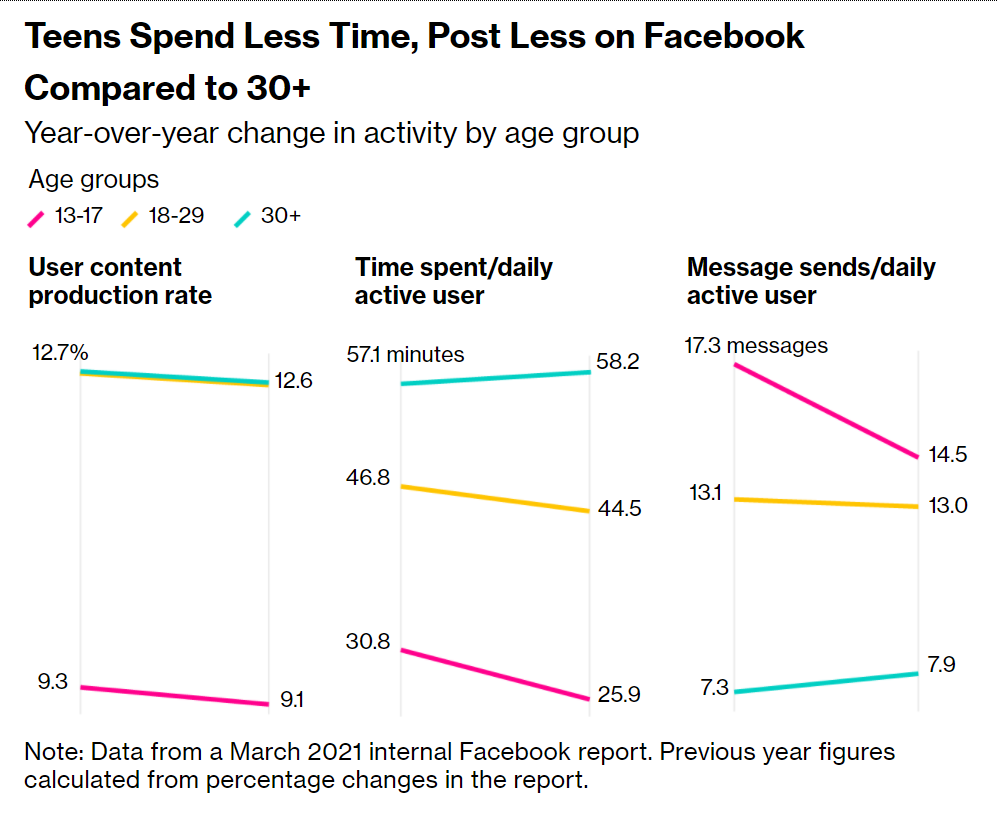

Put all these problems together and Facebook’s future is essentially them betting everything on zero in roulette and hoping it somehow works. The metaverse successfully becoming cost-efficient and recapturing engagement with young people is the zero on the roulette table. Every other number means failure. With fading engagement in its most important markets, unsustainable ad price growth and continually declining user growth rates, it appears unlikely to me that Facebook can a street forecast 16.15% revenue CAGR from now to 2025. With Reality Labs likely set to face delays and higher than expected costs like most in the development space have faced as of late, it’s likely that Facebook’s margins decline at a rate higher than analysts currently forecast. And with Facebook’s losses to competitors mounting across the board and complete failure to turn around the trend of young users rejecting them, Facebook decided to take a gamble to right the ship. The metaverse is the all-or-nothing bet. But Facebook’s failure to retain young users, attract content creators, and make themselves aligned with the interests of developers has made it so their metaverse gamble is set up to fail before it has even started. While everyone on Wall Street sees a company set to capitalize on a new space, I see something different. A value trap that is facing a long and slow decline.

Strat Becker

Comprehensive analysis of Facebook’s competitive position and (narrowing) future prospects. After its most recent earnings report, where the company reported its first-ever decline in global daily active users and a weak forecast, it appears that Wall Street finally got the memo and reacted wildly, with the share value dropping more than 20% in a single day.

This massive swing reflects once again the high volatility of the stock market and its loose connection to the broader economy – after all, the user decline itself looks pretty minor, and the underlying causes were apparent over the last years. Even when facing a decline, Facebook remains a huge company, so it won’t collapse overnight; many other tech companies before it have faded from the spotlight but continued to make profits and attempted to restructure and enter new markets. If the Meta gamble fails to gain traction, they will probably still have enough time and resources to pivot in another direction – what’s lacking is the necessary vision, and I doubt that Mark Zuckerberg at this point has any ideas besides the unlikely VR metaverse.

Post a Comment