The Risk from Unprofitable Firms

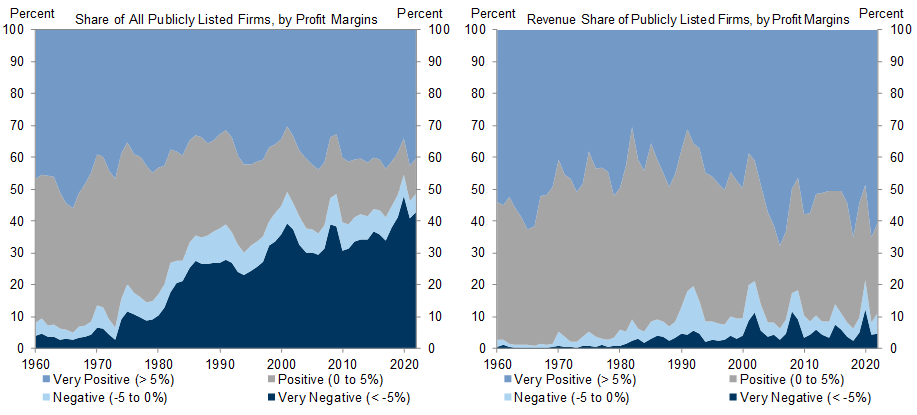

In the corporate sector, investors might hesitate to continue financing unprofitable companies that they hope will pay off well down the road now that the opportunity cost has risen. The number of unprofitable firms has risen in recent decades, reaching almost 50% of all publicly-listed companies in 2022 (Exhibit 7, left)[3]. The share of business activity that they account for is much smaller but still an economically meaningful 10% of total business revenues (Exhibit 7, right).

Unprofitable firms account for closer to 13% of capital spending and employment, and even just the smaller group of persistently unprofitable firms account for about 5% of employment (Exhibit 8).

Higher funding costs could force some of these companies to cut labor costs or even close. In previous research we found that unprofitable firms tend to cut capital spending more aggressively when faced with margin pressure, and we find they also cut labor costs more aggressively when hit with interest rate shocks (Exhibit 9, left). The larger risk is that some firms might simply have to close if their path to profitability is too distant. The exit rate of unprofitable firms is currently low by historical standards and has actually declined since the start of the pandemic, leaving it ample room to rise from here (Exhibit 9, right).

David Mericle & Ronnie Walker

Fascinating figures about the US economy: almost half of all listed companies are now unprofitable! Presumably an outcome of the near-zero interest rate regime that has dominated over the past decade, these companies can be expected to face increasing pressures to become profitable through comprehensive restructuring, or… go bankrupt or close down, contributing to higher unemployment and decreases in economic activity.

We recently had a high-profile showcase of such corporate failure by chronic unprofitability as WeWork filed for bankruptcy in early November, reporting total debts of $18.65 billion, and close to $16 billion in long-term lease obligations. On the flipside, Uber, another Silicon Valley unicorn famous for its unprofitable business model, managed to turn things around (for now), and reported its second straight quarterly profit. There are a range of factors that contributed to one’s failure as the other managed to push through, but in an environment of higher interest rates – and thus borrowing costs – overall there will be fewer companies to transition to profitability, and their room for maneuver will be much tighter – and that may actually be a good thing for the health of the economy.

Post a Comment