The most important thing to remember about the faux-prosperity of the last 30 years is that it was manufactured on the basis of paper profits. If my house was worth £3000 in 1973 and £1.5 million in 2012, it is still essentially the same house and gives me the same pleasure to live in. If we could manufacture demand by making bombs and if we could manufacture demand by making houses quadruple in price, then we can manufacture demand in other ways, perhaps more satisfying ways as well.

Tom Streihorst

The overview of the last century in terms of economic growth and crisis is great, but the proposed solutions are rather weak. Heavily investing in education will bring very little return in a rapidly changing world where the skill you are training for can become obsolete before you master it; even less if manufacturing is turned over to robots needing minimal supervision. And culture and art are unlikely to become an engine for growth – not unless our attitude towards work undergoes radical change.

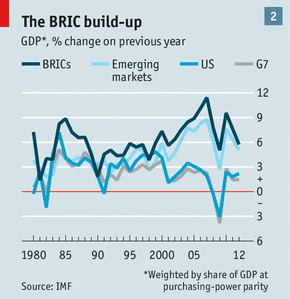

The article – or book – also takes a rather narrow view of the world, focusing only on western economies. There is plenty of growth in the developing world, even as it’s starting to slow down recently. External demand can be a healthier source of growth, as the huge population in the emerging markets starts having better living standards and purchasing power; investing in innovation, in new methods of producing power – preferably green power – and the related infrastructure; these are both more promising than nebulous funding for education.

The BRIC era arrived at the end of a century in which global living standards had diverged remarkably. Towards the end of the 19th century America’s economy overtook China’s to become the largest on the planet. By 1992 China and India – home to 38% of the world’s population – were producing just 7% of the world’s output, while six rich countries which accounted for just 12% of the world’s population produced half of it. In 1890 an average American was about six times better off than the average Chinese or Indian. By the early 1990s he was doing 25 times better. […]

There is a risk, though, that matters may move in the opposite direction. The rich world is more cautious about globalisation than it was a decade or two ago, and more interested in maintaining its export competitiveness. A century ago the world’s last great era of trade integration ended with a war and ushered in a generation of economic nationalism and international conflict. The recent proliferation of regional trade agreements could signal a move towards fractionalisation of the global economy. And slowed growth in the now-large BRICs could lead to the sort of internal tensions that countries can displace by picking external fights. Whether or not the world can build on a remarkable era of growth will depend in large part on whether the new giants tread a path towards greater global co-operation—or stumble, fall and, in the worst case, fight.

The Economist

Post a Comment