R.P.: The supply chain crunch was started by increasing demand for goods, as consumers stopped spending on services. Americans in particular had more money in their pockets because they weren’t going on trips, spending at restaurants and bars, or attending concerts. Instead as city after city started enforcing lockdowns and restrictions, people started spending a lot more goods and not services. You’ve got to get your dopamine somewhere. So what we saw was an unprecedented increase in imports from China—as much as 20% more containers entering the United States than were leaving our ports since the start of the pandemic.

Then there was the impact of cascading second orders that are inherently unpredictable. For example, as imports increased as much as 20%, exports actually decreased because the United States economy was slow to reopen. In fact exports are still down. If you look at the journey of a shipping container, it runs in a loop: The same container that brings in imports later helps transport exports out of the U.S. So if there are fewer exports going out, that means companies are consciously choosing to ship empty containers back to Asia or else they will run into shortages at the origin ports. At one point over the last year, as an industry, we were 500,000 shipping containers short in Asia. These shortages led to increases in prices. If you wanted to get a container you had to pay a real premium to get access. In some cases renting a container for one journey was more expensive than the price to buy one.

Noah Smith

Very informative discussion about the growing supply chain issues, their complex and world-spanning causes, and the lack of local investment and planning that has amplified the problems in the US more than in other regions. Since it was published at the beginning of the year, new factors have increased the strain on global supply chains and inflation, from the rise of coronavirus cases and subsequent lockdowns in major Chinese manufacturing hubs to the war in Ukraine.

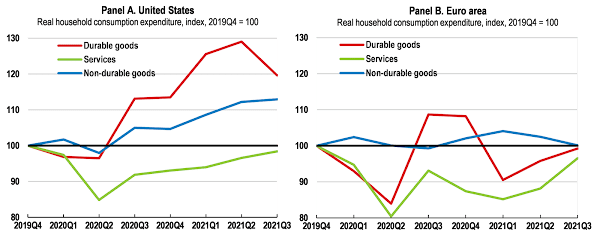

At the risk of sounding like a grumpy old man, people should really consider being more mature with their finances and purchasing choices. If you happen to have a temporary surplus, as it was the case during the early phases of the pandemic when spending on services decreased drastically because of social distancing and lockdowns, you don’t have to compulsively spend it on something else. (Low interest rates over the past years have discouraged savings though, a situation where immediate consumption is in fact more rational than delayed consumption because savings deliver minute returns). This is the dark side of capitalism, the unchecked consumerism, purchasing goods for the sake of spending instead of a valid need. This relentless demand triggered supply chain bottlenecks and is at least partially responsible for the current inflation surge in the US. In contrast, the inflation in the EU is driven primarily by higher fuel and energy prices, which naturally impact food prices, transportation, and finished goods.

If I remember my college-level macroeconomics correctly, another inflationary pressure ironically comes from… high employment rate! It’s supposed to be one of the accomplishments of the Biden administration, but low inflation and high employment don’t mix well together. Full employment fuels inflation through several mechanisms: the general mass of consumers have more disposable income and are more confident in future cash flows, which drives up demand for consumer goods and services. A saturated labor market also means that employees can demand higher wages, since companies have fewer hiring options; companies then push these increases in salary costs onto their products, raising prices – which people happily pay from their higher incomes. This self-reinforcing mechanism leads to macro-level inflation.

debatable, as it comes after a severe employment contraction in 2020 because of the pandemic. These may simply be jobs lost in 2020 that the economy is now recuperating. And we should take into consideration US’ high death toll, recently passing 1.000.000 – how many of these were working-age people lost from the workforce? Unemployment can decrease when there are just less people available…

We’re lucky to live in an economy that’s built on the principles of free enterprise, and so while it’s easy to cast blame and point fingers at the administration, we have to recognize that they’re not really in charge of all of these things. They didn’t create this situation and I’m not 100% convinced that they’re the ones that are going to be best equipped to solve the problem.

That said, there’s a very clear role for our government to intervene in markets when you have systemic failures. As much as we love the idea of a free enterprise system, the reality is that markets often fail. And when they do, we need our leadership to step in and help resolve problems. I think what we’re observing at West Coast ports right now can best be described as a market failure. So there must be some role for government to step in here. I outlined a few ideas for how the government can resolve supply chain bottlenecks in my Oct. 22 Twitter thread.

The second part of the interview unfortunately devolves into thinly veiled promotion for the logistic services provided by Ryan Petersen’s company, Flexport – a common failing of ‘access journalism’ where the interviewer is mostly providing a platform for his guest to display his ideas and pitches, without much questioning or pushback.

Post a Comment