It therefore came as a revelation when Piketty and his colleagues showed that incomes of the now famous “one percent”, and of even narrower groups, are actually the big story in rising inequality. And this discovery came with a second revelation: talk of a second Gilded Age, which might have seemed like hyperbole, was nothing of the kind. In America in particular the share of national income going to the top one percent has followed a great U-shaped arc. Before World War I the one percent received around a fifth of total income in both Britain and the United States. By 1950 that share had been cut by more than half. But since 1980 the one percent has seen its income share surge again—and in the United States it’s back to what it was a century ago.

Paul Krugman

While many talk about income inequality, its effects on economic recovery and the widening gap between the 1% and the rest, the book reviewed here has solid research on the subject based on economic data going back a century and more. It also lays out an easy theoretical solution: adjusting tax rates for capital returns and inheritance would improve income distribution considerably and slow further accumulation of capital in the same hands. Unfortunately, as you may imagine, it’s not so easy to apply this in the real world, where political decision-making is heavily influenced by those 1% it’s supposed to tax…

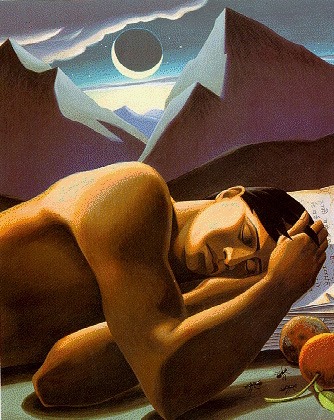

Pe o autostradă aglomerată din Tokyo, în acordurile simfoniei lui Janáček, tânăra Aomame e nerăbdătoare să ajungă la o întâlnire importantă de afaceri, atât de nerăbdătoare că acceptă sugestia neobișnuită a șoferului de taxi de a părăsi mașina în mijlocul șirului încremenit de automobile și de a coborî pe o scară de incendiu pentru a putea prinde un metrou în schimb. Punctualitatea este crucială, căci altfel planul bine pus la punct pentru asasinarea unui om de afaceri în camera lui de hotel s‑ar da peste cap! În altă parte a orașului, Tengo, profesor de matematică cu jumătate de normă și scriitor aspirant, se întâlnește într‑o cafenea cu editorul său, Komatsu, care vine cu o propunere pe cât de tentantă, pe atât de periculoasă. Komatsu a descoperit un manuscris fascinant al unei tinere de 17 ani, Fuka‑Eri, despre care e convins că ar putea câștiga un prestigios premiu literar, cu condiția ca Tengo să șlefuiască ideile bune ale fetei cu stilul propriu care ei îi lipsește cu desăvârșire.

Pe o autostradă aglomerată din Tokyo, în acordurile simfoniei lui Janáček, tânăra Aomame e nerăbdătoare să ajungă la o întâlnire importantă de afaceri, atât de nerăbdătoare că acceptă sugestia neobișnuită a șoferului de taxi de a părăsi mașina în mijlocul șirului încremenit de automobile și de a coborî pe o scară de incendiu pentru a putea prinde un metrou în schimb. Punctualitatea este crucială, căci altfel planul bine pus la punct pentru asasinarea unui om de afaceri în camera lui de hotel s‑ar da peste cap! În altă parte a orașului, Tengo, profesor de matematică cu jumătate de normă și scriitor aspirant, se întâlnește într‑o cafenea cu editorul său, Komatsu, care vine cu o propunere pe cât de tentantă, pe atât de periculoasă. Komatsu a descoperit un manuscris fascinant al unei tinere de 17 ani, Fuka‑Eri, despre care e convins că ar putea câștiga un prestigios premiu literar, cu condiția ca Tengo să șlefuiască ideile bune ale fetei cu stilul propriu care ei îi lipsește cu desăvârșire.

One of the interesting side-effects of going to work by metro – as opposed to, say, driving there – are the conversations you sometimes get to overhear. This morning, two people were talking about

One of the interesting side-effects of going to work by metro – as opposed to, say, driving there – are the conversations you sometimes get to overhear. This morning, two people were talking about